I’m looking at whether BAE Systems (LSE:BA.) shares still represent good value.

At first glance, it looks a high-quality business. There’s much to like about stable businesses that don’t suffer large swings between profit and loss. And BAE looks like one of the most stable companies in the FTSE 100.

In demand

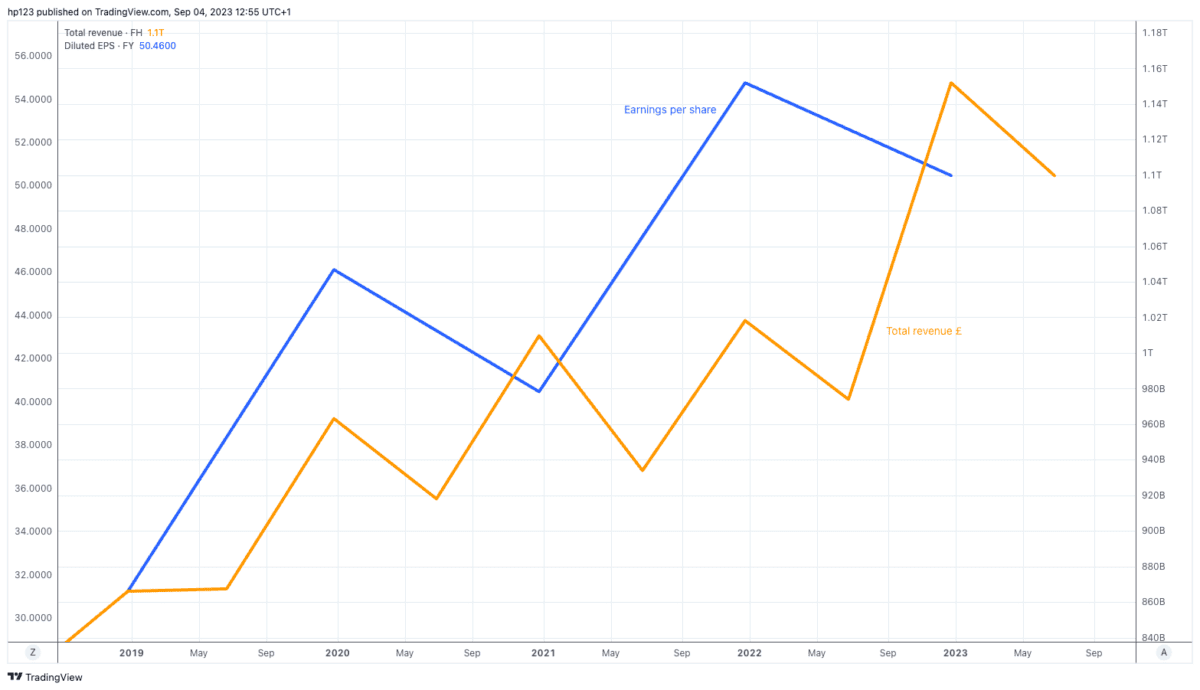

As we can see from this chart, over the past five years, sales and earnings have consistently risen. This trend is encouraging.

Should you invest £1,000 in BAE Systems right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if BAE Systems made the list?

As a leading aerospace and defence business, its operations span land, sea and air. From building advanced aircraft to cyber security solutions, BAE has its fingers in many pies.

Doing so allows it to spread risk and avoid putting all its eggs in one basket.

It recently signed agreements to work directly with the Ukraine and explored the supply of light artillery in the country. As security and defence remains a key desire for many countries, its earnings should be supported for quite some time, in my opinion.

BAE shares offer consistency

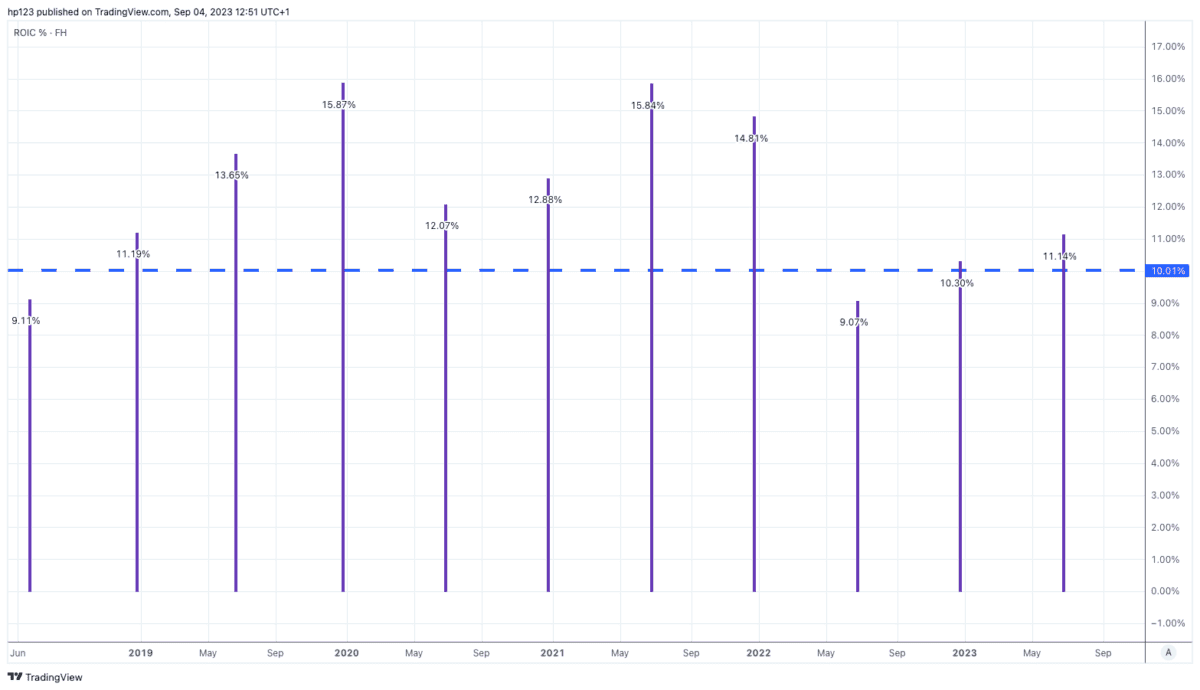

Some of the most renowned investors in the world frequently talk about return on capital employed as a key metric for quality shares.

As we can see from this chart, BAE shares offer a double-digit return on capital employed. Overall, it has consistently remained above 10% over several years. This is exactly what I want to see when fishing for the best quality shares to buy.

I’d consider dividend growth too

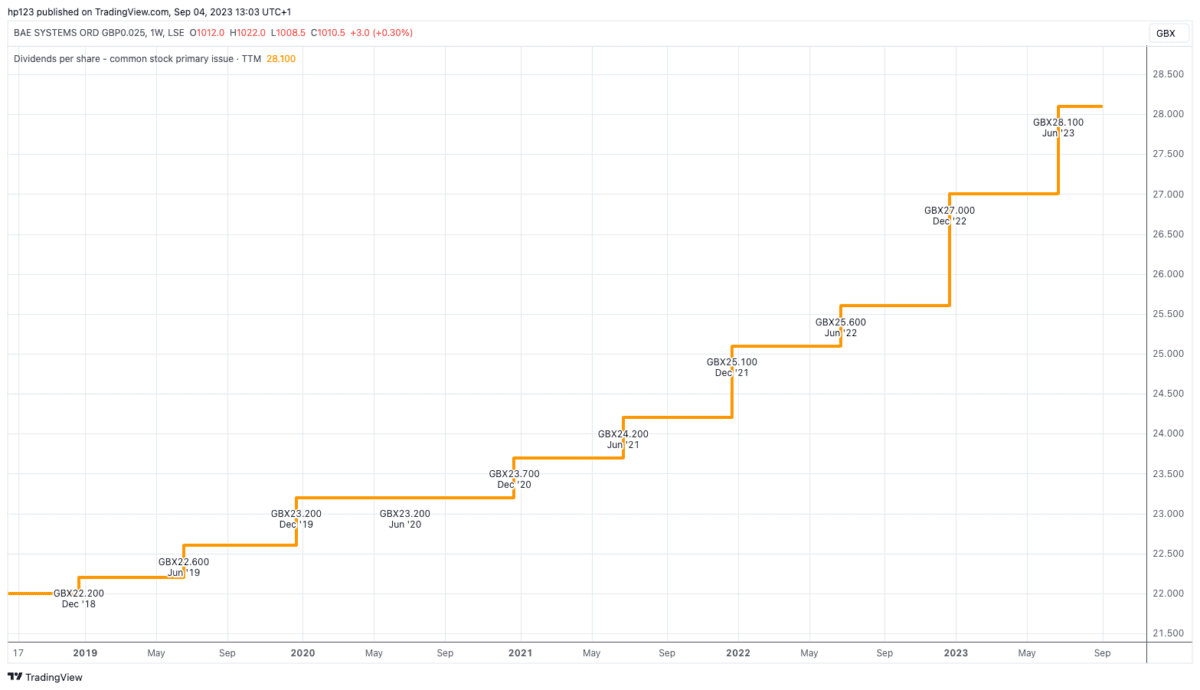

In addition, it’s nice to see it also offers a dividend yield of around 3%. That looks reasonable to me. It’s less than the FTSE 100 average yield, but it’s important to consider dividend growth too.

For instance, BAE consistently grows its dividend payments over time. As a long-term investor, this can have a significant impact on my investment.

For example, if I’d bought £5,000 of BAE shares five years ago, I’d own 825 shares. Back then, it offered 22p per share in annual dividends, so I would have received £182 in the first year.

But due to dividend growth, this year it’s offering around 30p per share, which equates to £248 of yearly income.

This example shows that although the yield five years ago was 3.6%, my yield on cost is closer to 5%. And that’s why dividend growth is often just as important as the starting dividend yield.

Good value

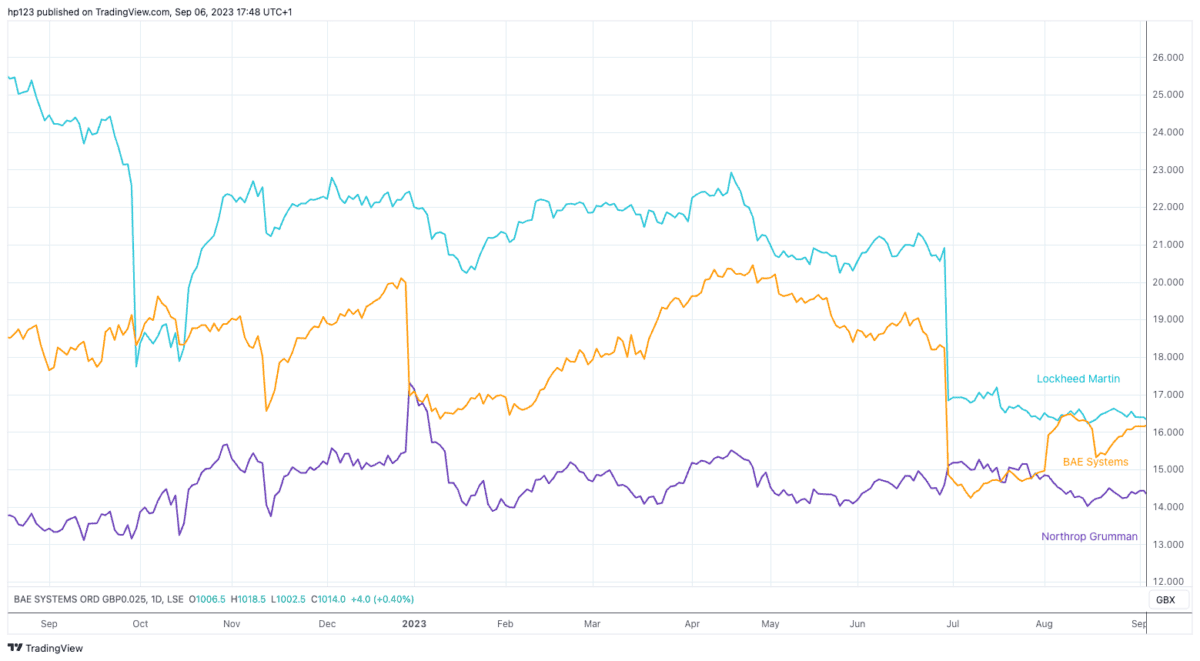

Typically, quality growth shares tend to command a greater price relative to its earnings. But with a price-to-earnings ratio of just 16, BAE Systems shares strike me as good value.

As we can see in this chart, when comparing global peers, it’s neither the cheapest nor the most expensive. It’s also in the lower end of the past year’s range, which looks encouraging to me.

If I owned this stock, I’d keep an eye out for any signs of changing government spending. Some 95% of the company’s sales are defence-related. Any slowdown in spending from countries could have a significant effect on BAE’s sales.

That said, it looks sufficiently diversified across several major countries, so it’s not much of a concern for me right now. Overall, I like what I see and if I had some spare cash, I’d add BAE Systems shares to my ISA today.